When many states implemented stay at home orders to help slow the spread of COVID-19, small businesses were faced with many challenges on how they would pay bills and cover their payroll when they weren’t allowed to open and conduct business. In the rush to help individuals and small businesses, the government passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which had a provision specifically focused on helping small businesses, the Paycheck Protection Program (PPP) Loan program. This component of the bill allowed businesses to apply for a loan in which the funds would be used to maintain their payroll and cover some operating costs. If the employer met the criteria under the PPP loan guidelines, the loan would be forgiven. While the money was helpful, there were issues with the initial parameters to have the loan forgiven.

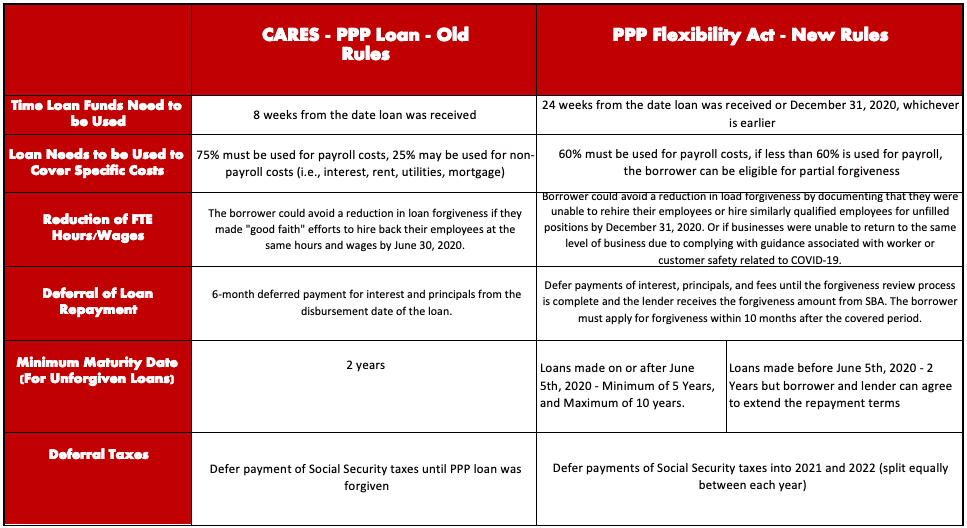

On June 5th, 2020 President Trump signed into law the Paycheck Protection Program Flexibility Act of 2020 which amends the original PPP Loan requirements to have the loan forgiven by borrowers. These changes were in response to many small businesses that claimed they would be unable to meet the strict criteria that were laid out originally to have the loan forgiven because of the delayed opening of their businesses and reduced occupancy as a result of the social distancing obligations. The chart below summarizes the changes.

ACA Section 1557 Ruling – New Protections Against Discrimination in Health Care

If you are a small business and have been affected by the COVID-19 pandemic, now is the time to act if you want to apply for a PPP loan. The Small Business Association (SBA) is in charge of determining loan forgiveness and has released the application and instructions. Seeing that the future spread of the Coronavirus is unknown, there could be additional changes in the months ahead.