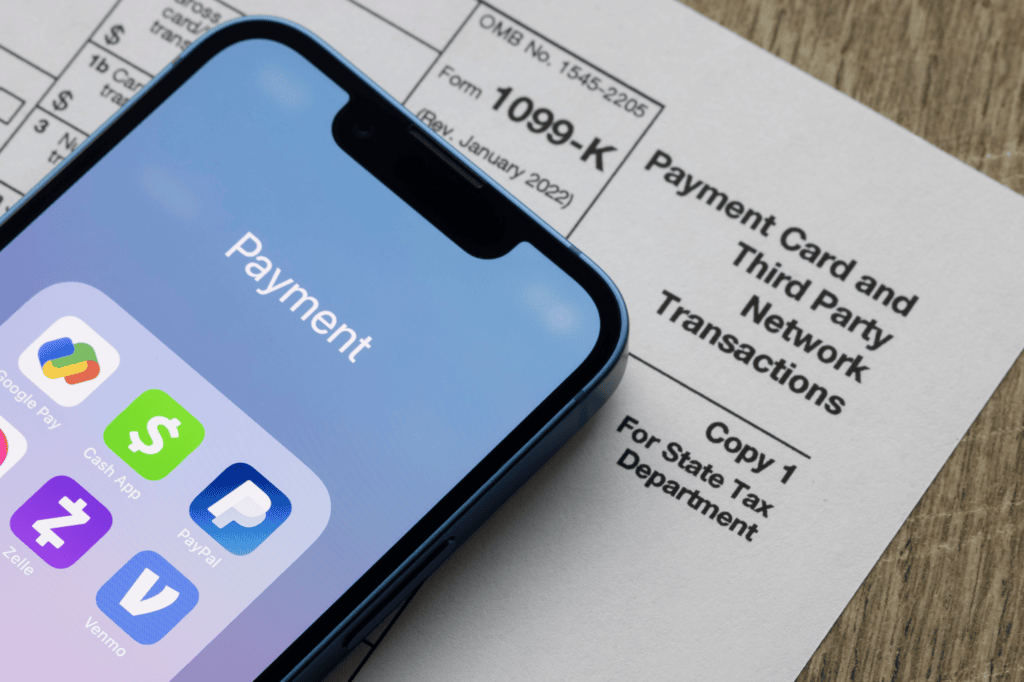

The Internal Revenue Service( IRS) announced on Dec. 23, 2022 that third-party settlement organizations will not be required, as previously instructed, to report tax year 2022 transactions on a Form 1099-K, Payment Card and Third-Party Network Transactions, to the IRS or the payee for a lower $600 threshold amount, regardless of the number of transactions, that was enacted as part of the American Rescue Plan of 2021, which changed the reporting threshold from the previous threshold of more than 200 transactions, exceeding an aggregate of $20,000. The law is not intended to track personal transactions. Birthday or holiday gifts, ride sharing, household bills, or paying family members transactions will not be tracked.

1099-K generation guidance from the IRS to third-party settlement organizations(TPSOs), including Venmo, PayPal, and CashApp, outlines calendar year 2022, which will be a transition period for the implementation of the lowered threshold. The IRS also noted that the existing 1099-K reporting threshold of $20,000 in payments from over 200 transactions will remain in effect.

“The IRS and Treasury heard a number of concerns regarding the timeline of implementation of these changes under the American Rescue Plan,” said Acting IRS Commissioner Doug O’Donnell. “To help smooth the transition and ensure clarity for taxpayers, tax professionals and industry, the IRS will delay implementation of the 1099-K changes. The additional time will help reduce confusion during the upcoming 2023 tax filing season and provide more time for taxpayers to prepare and understand the new reporting requirements.”

Notice 2023-10 describes the reporting delays of transactions in excess of $600 to transactions that occur after calendar year 2022. The transition period is intended to facilitate an orderly transition for TPSO and individual payee tax compliance with income tax reporting. A participating payee, in the case of a third-party network transaction, is any person who accepts payment from a third-party settlement organization for a business transaction.

Tax compliance is the end goal. The change under the law must be managed carefully to ensure that Form 1099-Ks are only issued to taxpayers who should receive them. Educating taxpayers, tax preparers and software providers is forefront in the IRS’s interest as they continue to share the importance of understanding what to do and how to assist with these changes. The IRS also noted that the existing 1099-K reporting threshold of $20,000 in payments from over 200 transactions will remain in effect.

SPS/GZ will report additional details on the delay as they become available. In the event taxpayers may have already received a 1099-K as a result of the statutory changes, the IRS is rapidly working to provide clear instructions to taxpayers so that they understand what to do. We are a full-service tax reporting and stock plan administration firm that provides personalized service and exceptional support, utilizing state-of-the-art technology to business clients of all sizes. We create and e-file, various 1099s, including 1099-NEC, Forms 1042-S, 1098-T, Affordable Care Act tax forms, and Forms 3921 and 3922. Our complete and affordable solution allows administrators to simply upload their tax form data file to our secure portal in a few simple steps and we handle everything else to keep your organization compliant. Contact us today at sales@greenzapato.com or call at (888)375-3049.